December 19, 2021

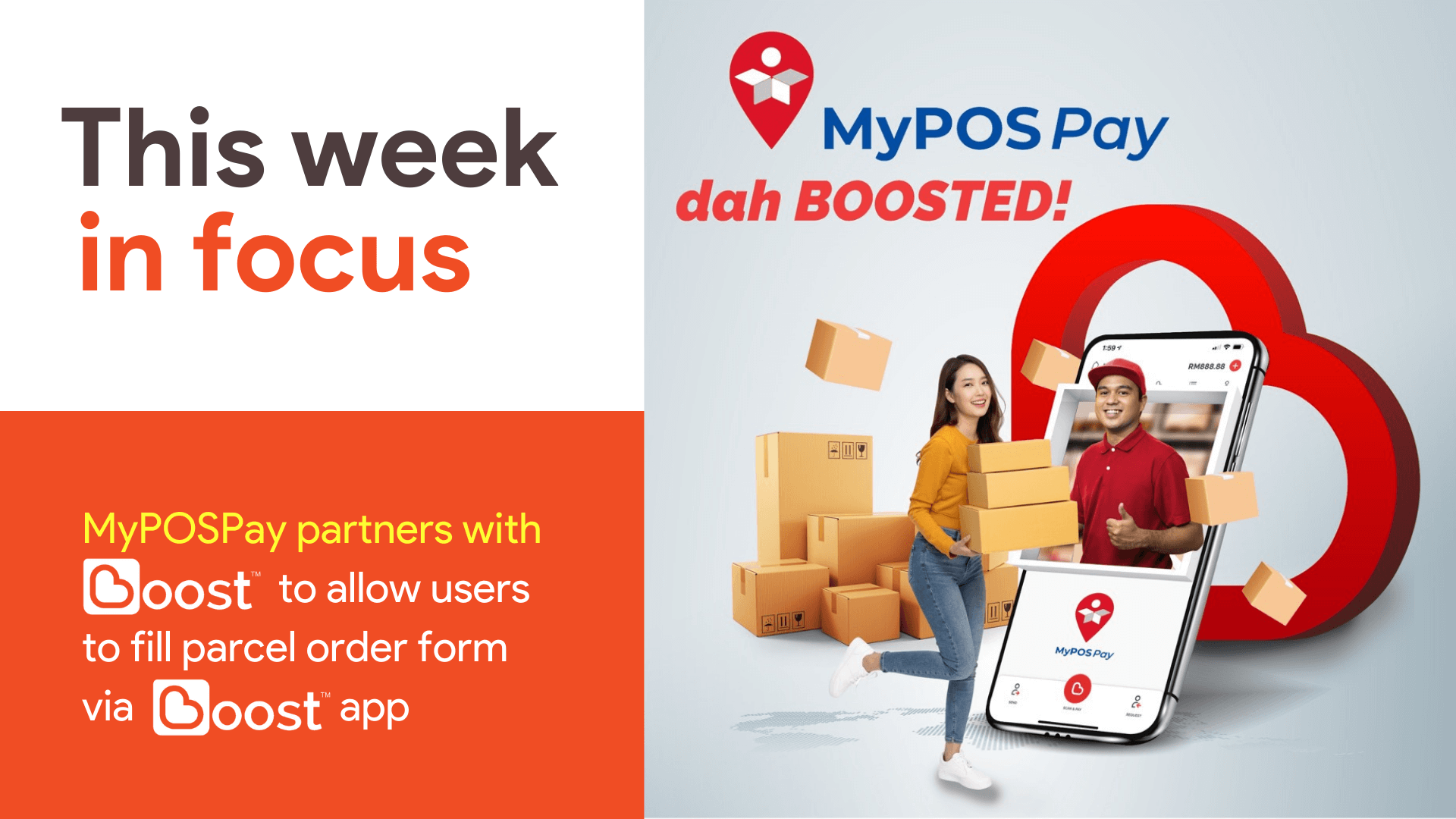

MyPOSPay has partnered with Boost to allow users to fill parcel order forms via Boost app and drop-off at the nearest MyPOSPay outlet.

The rapid rise of e-commerce has seen an increase in the number of online shoppers within the competitive e-commerce market space where nearly 82.3 per cent of Malaysians are shopping online for most of →